what does liquidating stock mean

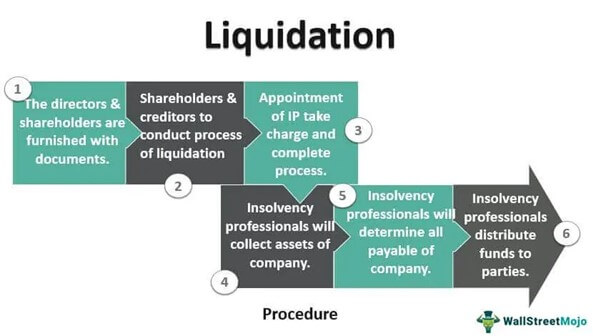

This happens when the business of a company is closed. Liquidation Due to Corporate Bankruptcy If a company files a Chapter 7 liquidation bankruptcy the company essentially vanishes from existence.

How To Liquidate Excess Inventory On Amazon Ultimate Guide

Proceed to Liquidate Stock.

. Your stockbroker can execute the sale orders or you can do so using an online brokerage account. If your broker sells each individual position you must tell her what number of shares of a particular stock you want to liquidate. Learn about our editorial policies.

When a company faces a delisting it means its being taken off of the major exchanges like the NYSE NASDAQ and AMEX onto the over-the-counter OTC or Pink Sheets unless its being taken private. Transactions that close or offset a short or long -term position. Liquidating any stock holding particularly a large stock portfolio is a serious undertaking.

What does liquidating your assets mean. Any stock or inventory could be considered current assets if the business is. 2 days agoKey Points.

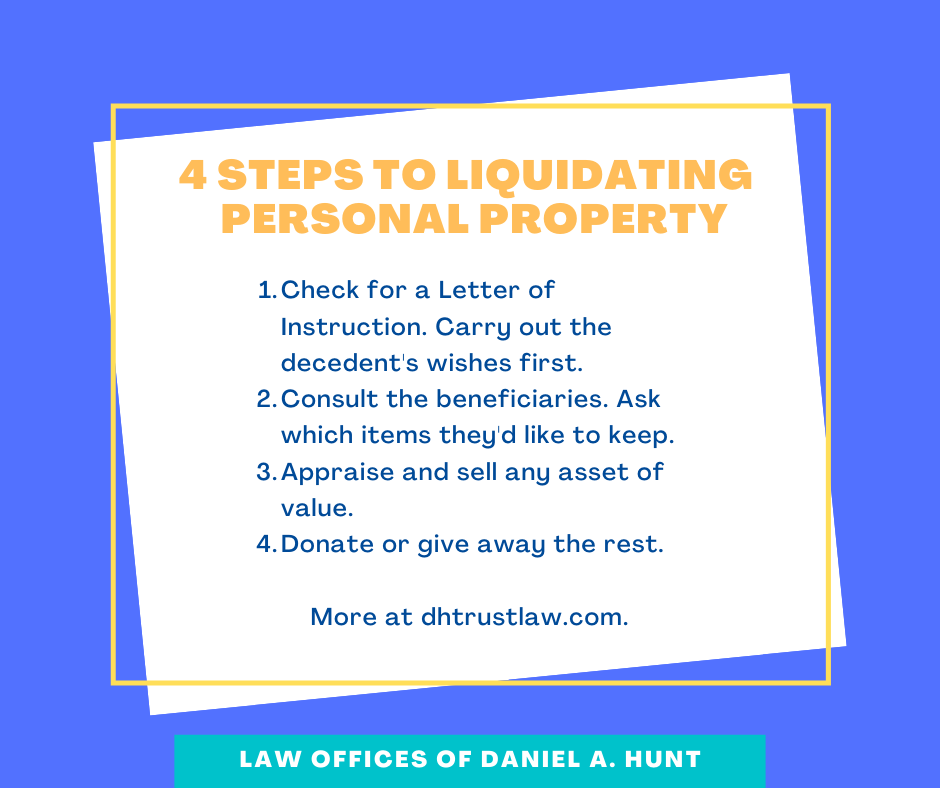

Any leftovers are then distributed to shareholders. When you decide to liquidate your assets you are selling those specific assets in exchange for cash or cash equivalents. Liquidating a stock means selling it for cash.

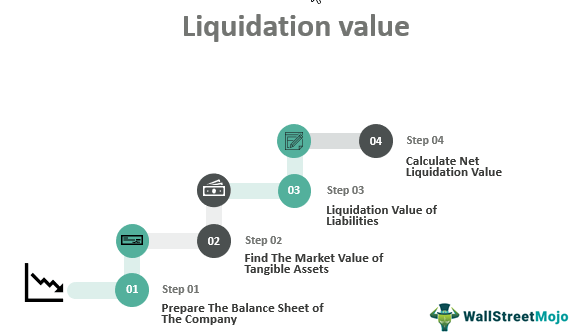

Due to the risk associated with leverage trading some exchanges have. The term liquidation means the process of selling an asset in return of its monetary value at the time of sale. To make it usable stockholders need to sell it ie liquidate it to lock in its value.

Starting in mid-August TD Ameritrade will only accept orders to liquidate positions ie no new buy orders in the 5000 or so listed securities. The liquidation of a. Technically its a drop of 20 or more from recent highs.

In Stock Market Dictionary. The assets are sold and the proceeds used to repay creditors. If you enter a sell order using your brokerage account you enter the number of shares.

For instance if you use 5x leverage your position will be liquidated if the price of an asset moves 20. Liquidation is the process of turning assets into cash. In a nutshell a delisting means the stock is being evicted from the major trading exchange and relegated to the less liquid OTC and.

Cash is the most common liquid asset because it can freely flow to wherever the business needs it. An account liquidation occurs when the holdings of an account are sold off by the brokerage or investment firm where the account was created. All penny stock investors should take notice as this will undoubtedly negatively affect the stock prices of all listed securities especially considering that TD Ameritrade is the second.

The liquidation process is a possible outcome of bankruptcy which a company enters when it does not have sufficient funds to pay its creditors. The price of a stock is continually fluctuating based on market conditions which makes it unusable for daily transactions just try paying for lunch with a share of Johnson Johnson. Purchase in Evening up Offset liquidity.

In most instances stock liquidation occurs when shareholders sell their shares on the open market for ready cash. Answer 1 of 8. A stock liquidation occurs when stock shares are converted into cash.

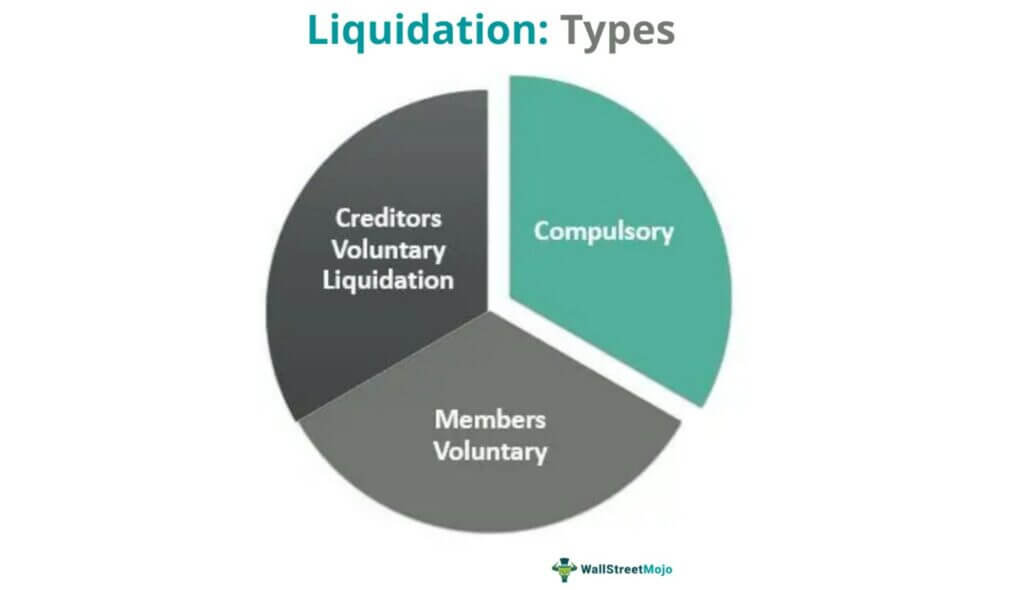

For example you own a share of Reliance Industry which you had purchased at the value of 1100 a share a few months back. While any asset or investment can be liquidated this type of sale often refers to the process of disposing of all assets of a company that has filed for bankruptcy a legal process in which the company declares it cant pay its debts and works to settle with its creditors. Stock liquidation which can occur due to bankruptcy company takeovers stock sales or margin calls means the stock is sold in exchange for some money.

What happens when stock is liquidated. Call your stockbroker to discuss your choices in liquidating your stock. Other examples are when one company acquires another and sells off its shares and when a company ceases operations.

Bankruptcy is related to a. Bear market is a term used by investors to describe a steep and sustained market downturn. Liquidation 100 Leverage.

Liquidation is the process of selling off all the assets of an entity settling its liabilities distributing any remaining funds to shareholders and closing it down as a legal entity. This means if bitcoins price falls so too does the amount of funds held in collateral resulting in faster liquidations.

Liquidation Preference Overview Shareholders Practical Example

Lifo Liquidation Definition How It Works Why It Occurs

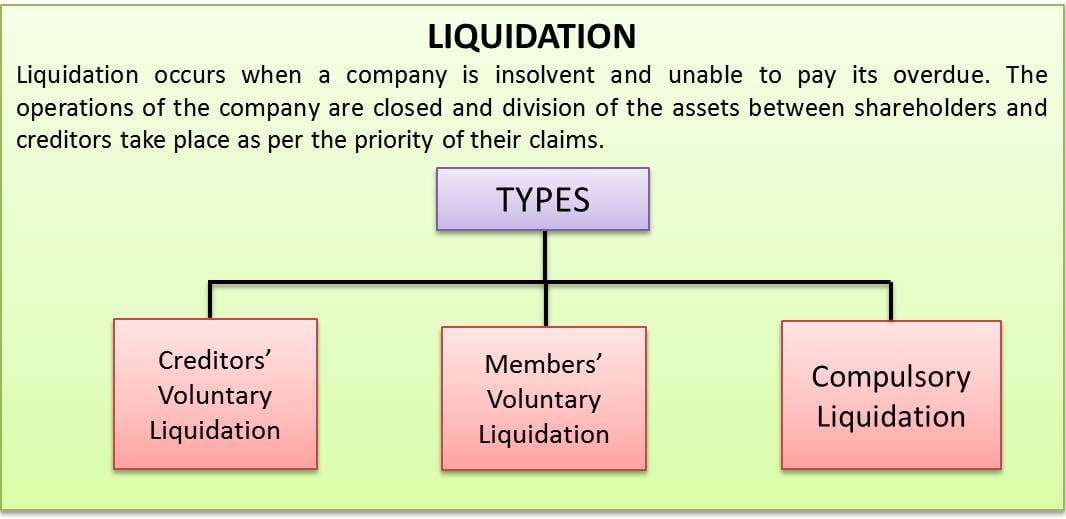

Liquidation Definition Meaning Types And Process Efm

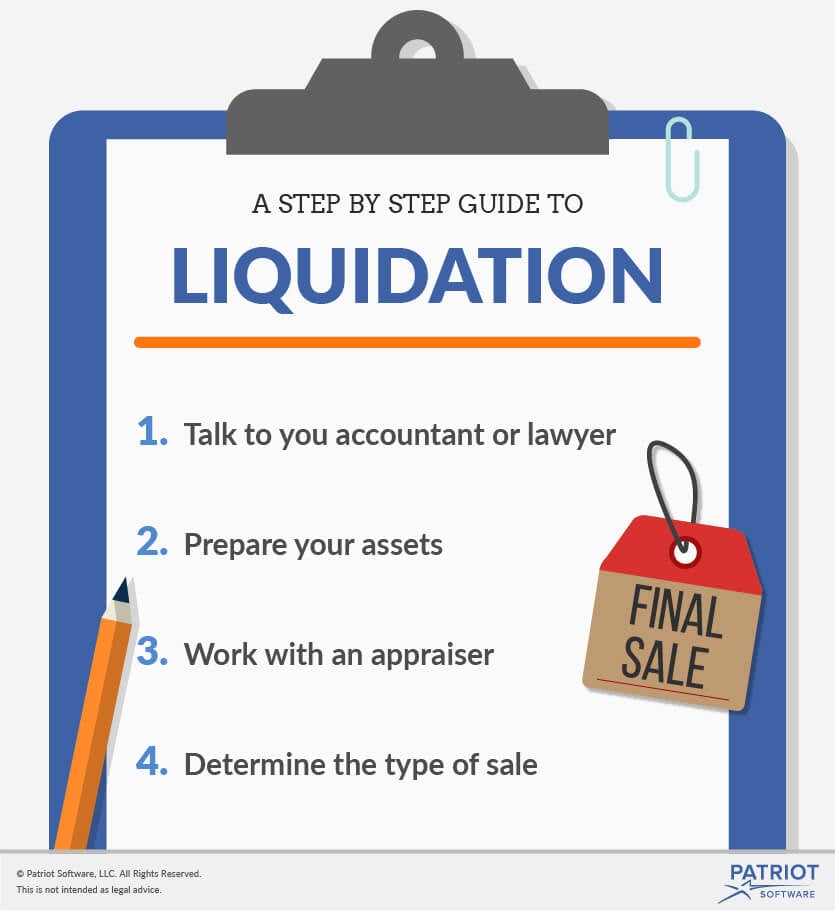

Small Business Liquidation What Is Liquidation In Business

Liquidating Amazon Inventory 8 Ways To Sell Off Your Stock

How To Estimate The Size Of Liquidation Merchandise B Stock Solutions

Meaning Of Liquidation Reasons For Liquidation And Calculation Of Liquidator S Remuneration The Accounting Brain

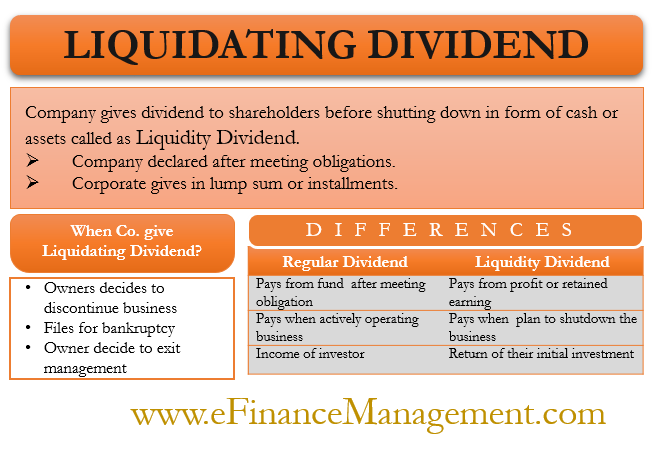

Liquidating Dividend Meaning Example And More

Liquidation Meaning Process Types Examples Consequences

Liquidation Value Formula Example Step By Step Calculation

What Is The Meaning Of Liquidation Definition Of Liquidation

How To Liquidate Assets Post Death Law Offices Of Daniel A Hunt

Liquidation Meaning Process Types Examples Consequences

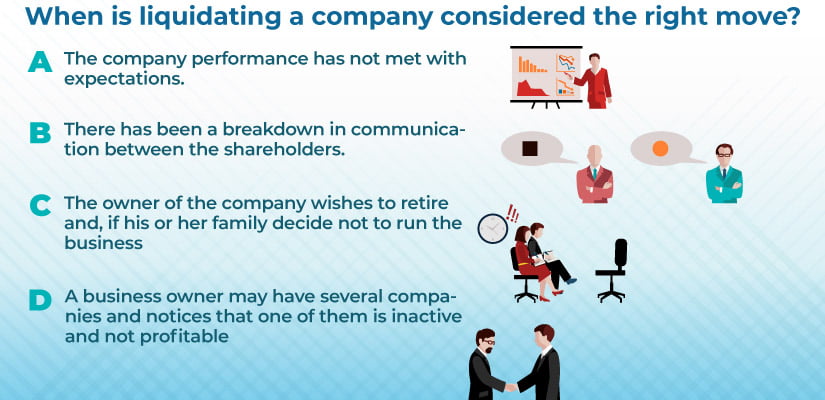

Liquidate A Company What Are The Steps To Be Taken

Let S Refresh The Liquidation Basis Of Accounting Gaap Dynamics

/GettyImages-1064821934-edef6bd98aef40e59a5611816dc745a2.jpg)

What Happens To The Shares Of A Company That Has Been Liquidated

/GettyImages-1005470094-d3c3108c195f40f3a1244331105e18f5.jpg)