nebraska tax withholding calculator

Switch to Nebraska hourly calculator. There are no local income taxes in.

![]()

Nebraska Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Nebraskas state income tax system is similar to the federal system.

. State Date State Nebraska. Its a progressive system which means that taxpayers who earn more pay higher taxes. The lowest tax rate is 246 and the highest is 684.

Your results will only account for federal income tax withholding. - Nebraska State Tax. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in a given calendar year.

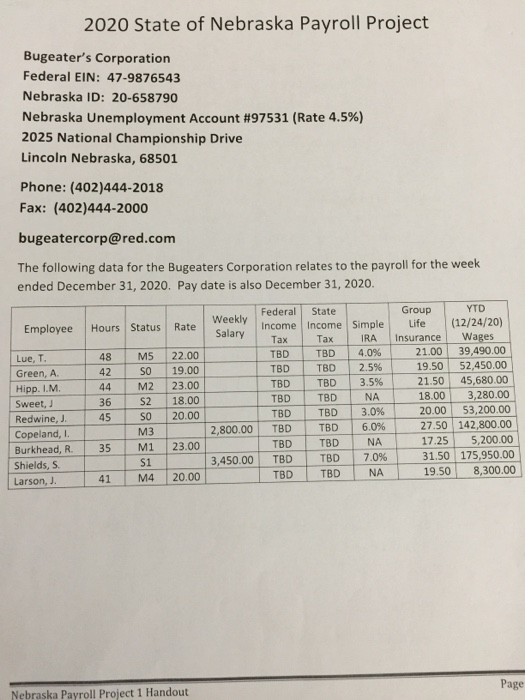

Nebraska tax withholding calculator. Nebraska Nebraska Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. This results in roughly 12285 of your earnings being taxed in total although.

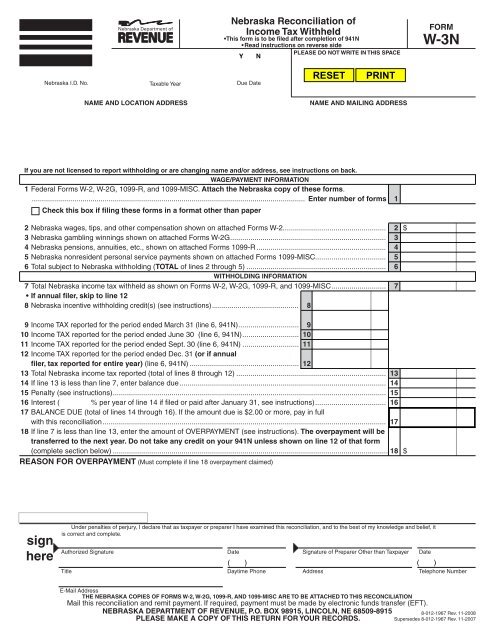

12 rows Special Income Tax Withholding Rate. Nebraska Income Tax Withholding Return Form 941N Nebraska Monthly Income Tax Withholding Deposit Form 501N Nebraska Reconciliation of Income Tax Withheld Form W-3N Federal Forms W-2 and 1099 File Form 941N Frequently Asked Questions Benefits of the Form 941N online system It uses a simplified 7-line form. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

State Date State Nebraska. This Nebraska hourly paycheck calculator is perfect for those who are paid on an hourly basis. Change state Check Date General Gross Pay Gross Pay Method.

Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. The special income tax withholding rate remains 15. Filing 5750000 of earnings will result in 439875 being taxed for FICA purposes.

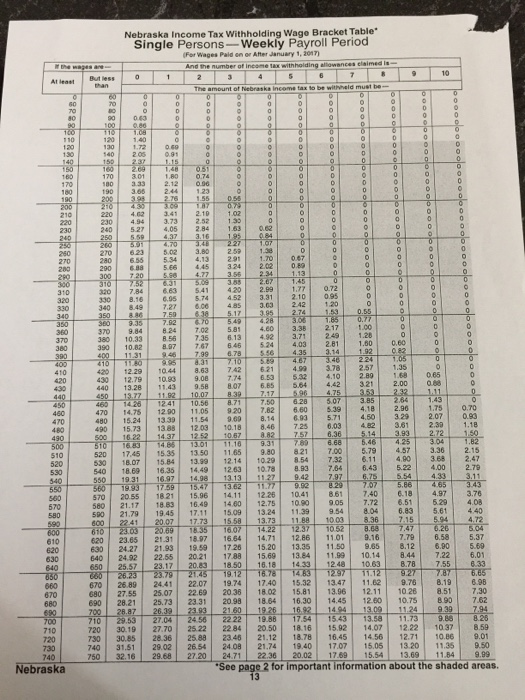

Employers using the wage bracket tables may continue to use the shadednonshaded areas of the bracket tables to determine if special income tax withholding procedures apply. Usually you can calculate Nebraska payroll income tax withholdings in the following ways. Instead you fill out steps 2 3 and 4.

The special income tax withholding rate remains 15. Any annual salaries above 142800 are exempt which means that the cumulative yearly Social Security withholding cannot exceed 885360 142800 x 62. You must pay estimated tax if you dont have your tax withholding taken out by an employer or if you are self employed.

19 in Nebraska and Alabama 21 in Puerto Rico Identity. Filing 5750000 of earnings will result in 246811 of your earnings being taxed as state tax calculation based on 2022 Nebraska State Tax Tables. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Nebraska.

For employees who earn more than 200000 per year youll need to withhold an Additional Medicare Tax of 09 which brings the total employee Medicare withholding above 200000 to 235. Switch to salary Hourly Employee. You must also match this tax.

Social Security is a flat 62 withholding tax for wages up to 142800 for the 2021 tax year. This Nebraska bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. There are four tax brackets in Nevada and they vary based on income level and filing status.

Payroll check calculator is updated for payroll year 2022 and new W4. State Date State Nebraska. Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Nebraska paycheck calculator.

Employers using the wage bracket tables may continue to use the shadednonshaded areas of the bracket tables to determine if special income tax. Tax Information Sheet Launch Nebraska Income Tax Calculator 1. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

The Nebraska income tax has four tax brackets with a maximum marginal income tax of 684 as of 2022. Other paycheck deductions are not taken into account. Nebraska Income Tax Table Tax Bracket Single.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Change state Check Date General Bonus Gross Pay Gross Pay Method Gross Pay YTD Pay Frequency Use 2020 W4 Federal Filing Status Step 2. Free federal and nebraska paycheck withholding calculator.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. A detailed transaction summary is available.

Calculate Nebraska state tax manually by using the state tax tables Use payroll software to automate the tax calculations Hire an accountant Option 1. The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State Income Tax Rates and Thresholds in 2022. Why Use the Estimator When Should You Use the Estimator.

Special Income Tax Withholding Rate. In 2012 nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable.

W 4 State Withholding Tax Calculation 2020 Based On The State Or State Equivalent Withholding Certificate

I Really Need Help Please Help Me I Need Get Them Chegg Com

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Nebraska Paycheck Calculator Smartasset

Nebraska Income Tax Ne State Tax Calculator Community Tax

Payroll Calculator Free Employee Payroll Template For Excel

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

I Really Need Help Please Help Me I Need Get Them Chegg Com

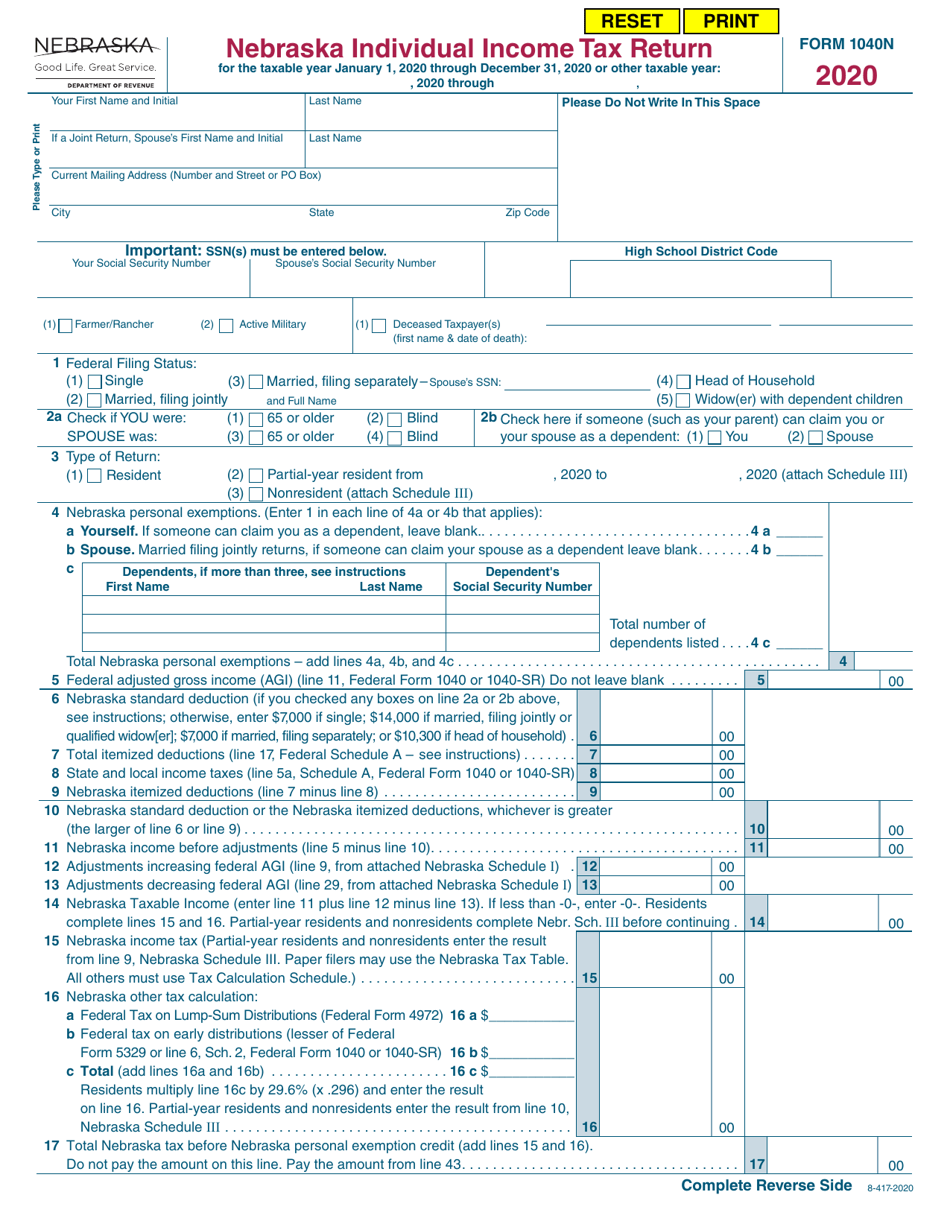

Form 1040n Download Fillable Pdf Or Fill Online Nebraska Individual Income Tax Return 2020 Nebraska Templateroller